who is exempt from oregon wbf

This assessment is calculated based on employees per hour worked. Who are subject workers.

Gusto Help Center Oregon Registration And Tax Info

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled.

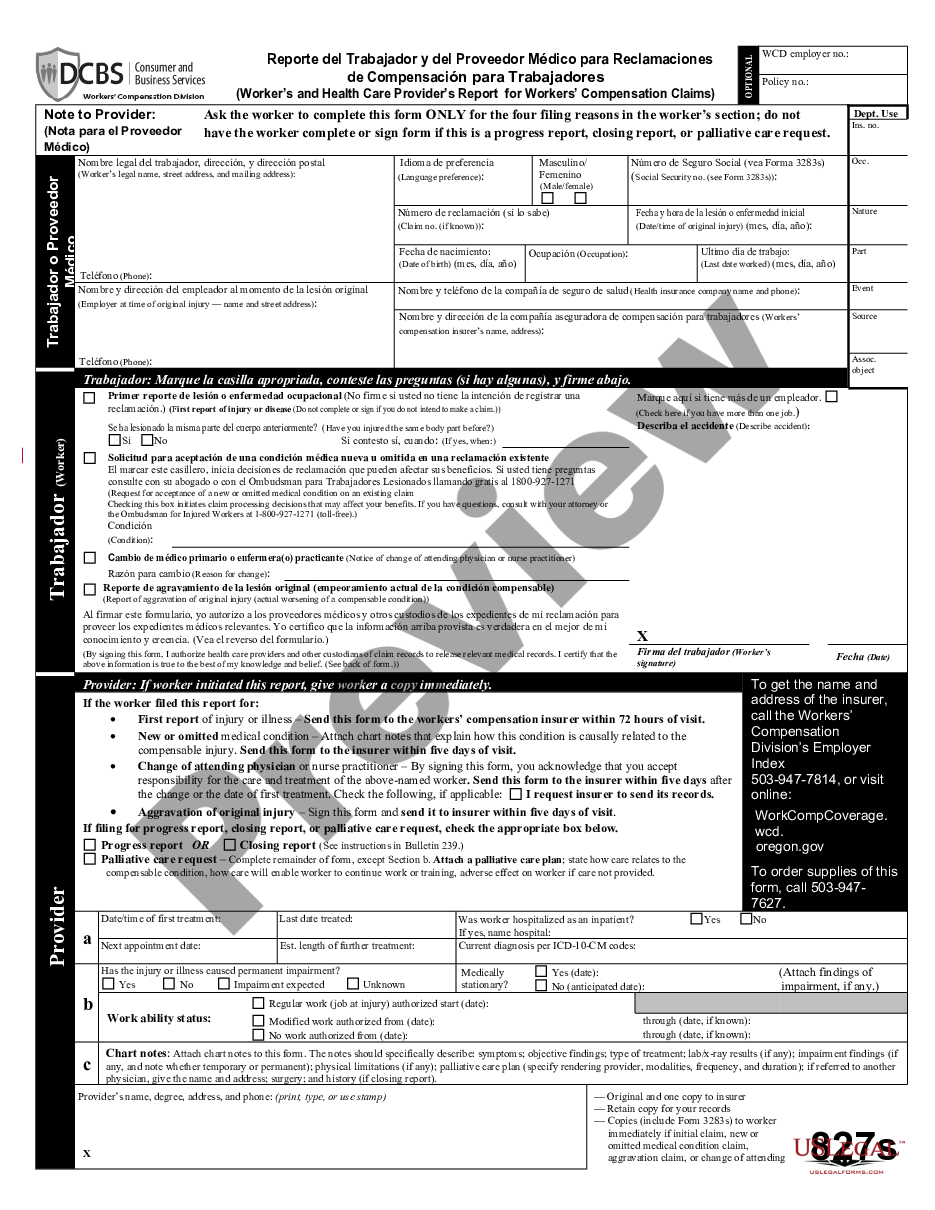

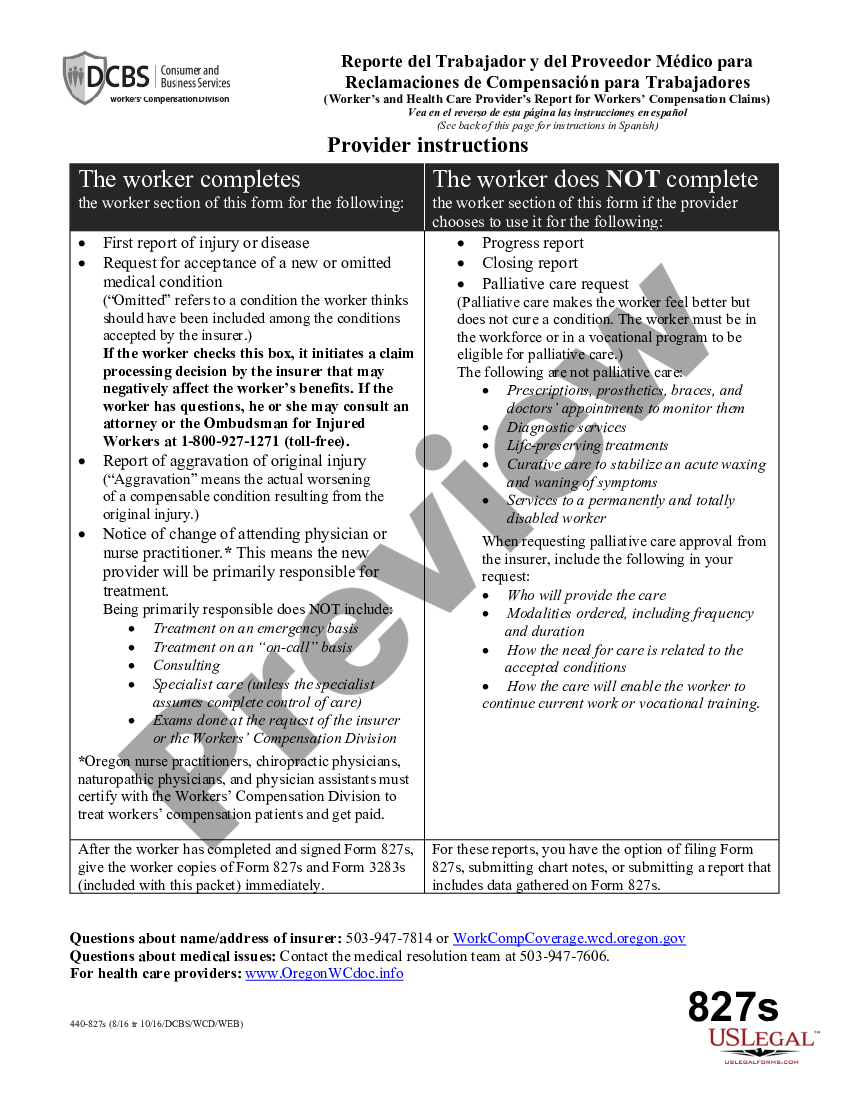

. Click the Other tab and click the OR WBF tax. The exemption in ORS 267380 Definitions for ORS 267380 and 2673852c applies to labor not in the course of the employers trade or business. Am I a subject employer.

The Edit Employee window opens. The oregon state state tax calculator is. Oregon Workers Benefit Fund assessment unchanged for 2022.

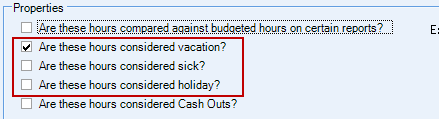

Oregon Workers Benefit Fund. You can exempt the amount under Oregon Rev. Accruable benefit hours should be exempt from WBF calculations and ideally accruable benefits should be set up in Accounting CS as accruable benefits not as separate pay items.

Who is exempt from oregon wbf. Oregon workers are subject to Workers Benefit Fund WBF assessment tax. In Oregon there are about 30 exemptions and most are in Oregon law.

The exemption does not apply to wages. 1 A worker employed as a. Click the Taxes button to display the Federal State and Other tabs.

Claims for Tortious or Negligent Conduct. All workers are subject to this chapter except those nonsubject workers described in the following subsections. We recommend that the wbf assessment rate be lowered to a combined 22 cents per hour for calendar year 2020.

Click the Payroll Info tab. With the new state-specific form employees will no longer need to complete a separate federal Form W-4 and write For Oregon only at the top to. Every worker in Oregon is a subject worker unless the worker falls under an exemption.

The Workers Benefit Fund WBF assessment this is a payroll assessment calculated on the basis of hours worked by all paid workers. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF.

For 2022 the rate is 22 cents per hour.

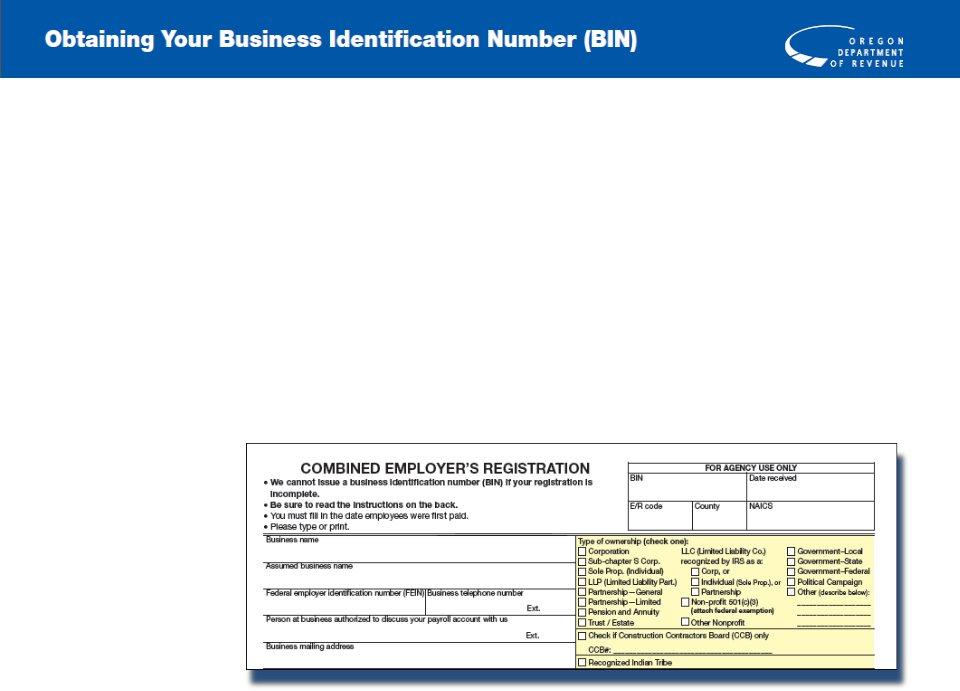

Bin Oregon Fill Out Printable Pdf Forms Online

Oregon Workers Benefit Fund Payroll Tax

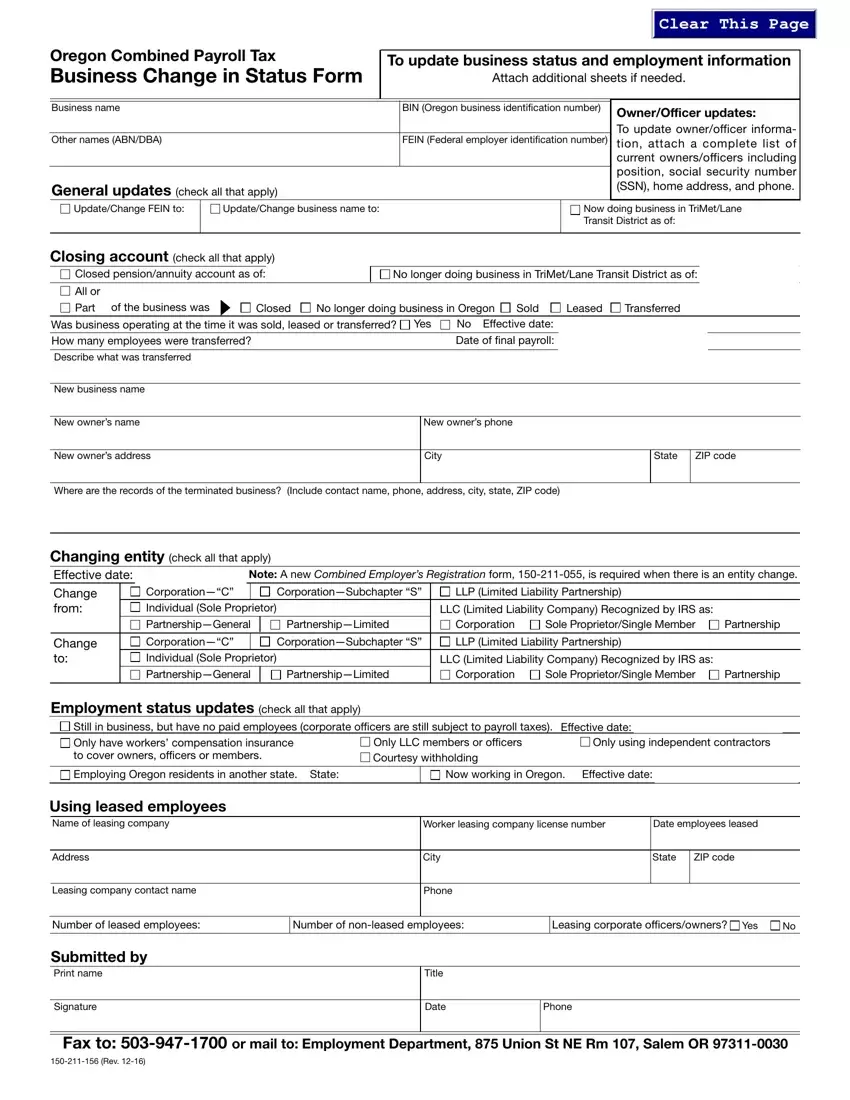

Oregon Payroll Tax And Registration Guide Peo Guide

Construction In Process Tax Exemption For Oregon Businesses

Oregon Wholesale Exemption Guidelines

Form 150 211 055 Combined Employer S Registration

Bin Oregon Fill Out Printable Pdf Forms Online

Oregon Workers Compensation Employee Withholding Us Legal Forms

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Workers Compensation Employee Withholding Us Legal Forms

This Week In Wild Beauty June 4th 2022 Wild Beauty Foundation

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Compensation How It Works

This Week In Wild Beauty June 4th 2022 Wild Beauty Foundation